Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Spotify | Amazon Music | RSS | More

Money Series Finale

We will finish off this powerful money mindset series by looking at four different money personalities. If you’ve missed any of the past 3 episodes, listen in because my interviews and discussion about money were designed to support you as you remove money blocks and strengthen your relationship with money.

Often we are so sure that our thoughts about money are facts of life instead of beliefs that we’ve been taught. This is because our thoughts and beliefs are often echoed by those around us and are lessons we learned growing up. It’s possible you hadn’t even heard of the term money mindset before this series or known that it’s a thing we have and something we can change.

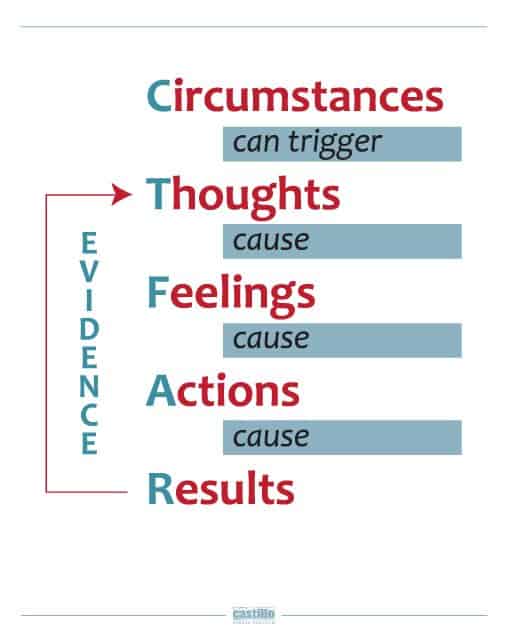

In general, when we separate out the facts from our thoughts we feel free and empowered. It has been so important for me to separate out the facts of what is happening from what I’m making that mean that that’s why I got into coaching. Every day, a main part of my work is to help people separate out the facts of life from the drama that we add…(eg fact: my friend didn’t respond to my text yesterday versus thought: she must be angry with me). Well if we go there with something as simple as a text you can imagine the drama we can add to money….. Money is literally just math. Numbers. Our thoughts add the drama. This is why one person with $10,000 in the bank can feel like that’s not enough while another can feel like they are rich and affluent.

Here are some common thoughts about money:

Talking about money is hard.

Money is the root of all evil.

Money is hard to get.

Rich people are greedy.

You have to work hard for your money.

It’s wrong to want money.

Money Thoughts

What do you think about money? How do you feel about money? How do you want to feel about money? How much time have you spent thinking about money and your thoughts about money?

Money is not something we talk about yet I promise you, the more you learn about what you think about money and how those thoughts make you feel, the better you will feel and the more peaceful a relationship with money you will have.

Drop The Judgement, Blame or Shame

Our entire life is a self-directed education of ourselves. We are here to learn about ourselves: why we do what we do and why we’ve done what we’ve done. The more we learn about our self and why we do what we do, the more in alignment we live with our values and the better we will feel. Our learning will be swifter and more profound if it is done through a lens of compassion. When we look at ourselves and our life without judgment, shame or blame, we are open to learn and grow. Drop the judgement of yourself. Know that wherever you are with your thoughts about money and whatever numbers are on your accounts, it’s all okay.

Four Money Personalities

The four money personalities we will speak of today are: Spender, Saver, Avoider, Money Monk. You may recognize pieces of yourself in each or all types and that is fine. The key is to keep an open and curious mind so as to further grow, heal, and release our money blocks.

1. The Spender

The spender likes to spend. If s/he has money, she spends it. She even spends if she doesn’t have money. She likes to give extravagantly to her friends and to herself. Spenders often see their possessions as extensions of their self worth. If they have the nice car or a fancy handbag, they feel respected and important. When someone gives them a gift, they feel loved.

Spenders are often very concerned with what other people think of them and how they appear to others. Whether or not they can afford it, that Louis Vuitton bag or new fancy car makes them feel respected.

Common behaviors of Spenders:

-Your closet has items that have never been used, possibly with the tags still on.

-You usually have a package coming in the mail or a shopping bag in your hand.

-You like to wow your friends with gifts.

-You have a place in your house to hide your purchases.

-You talk yourself into purchasing something by telling yourself: “I deserve this”

-You often have debt, spend impulsively, and avoid looking at bills.

Advice for Spenders

- Look at your numbers. Separate out fact from fiction. How much money do you have? How much does it take to run your house? How much extra is available to spend? What are your long term saving’s goals?

- Brainstorm on the value you bring to others lives that doesn’t have to do with possessions or things. Do you enjoy sitting and talking with people? Spenders often have low self esteem. Thinking thoughts like “people like me because of what I provide” or confusing their self worth with their net worth. If you have the thought that you’ll lose friends if you stop spending money on them, here’s a permission slip to get a coach. You are worth far more than an extravagant gift or fancy meal.

- A certain amount of spending is fine yet anything done to the extreme is unhelpful. If you identify as a spender, you’re going to be your best self when you set spending limits ahead of time, using your adult brain. It would be super helpful for you to keep a wish list of things you want instead of purchasing them as you think of them. Use the 24-hour tool from my earlier post.

2. The Saver:

On the other side of the coin, pun intented, is the personality type called the Saver.Savers like to save their money. They think money belongs in a bank account and they often have trouble spending it. They often think they don’t deserve nice things and don’t feel worthy of spending on items that are nice when there’s the option of “good enough”.

They also have a fear of running out of money or not having enough some day. Savers see money as security and without their certain “safe amount”, they feel nervous and out of control. Yet, no matter how much money a saver has, she will always fear that one false move or unexpected disaster will make her poor.

Common behaviors of Savers:

-You have trouble spending money on yourself.

-You are always looking for the best deal, a great bargain, or the sale rack.

-You have a hard time admitting to your partner (or yourself) that you paid full price for something.

-Savers are always saving their money for that hypothetical rainy day.

Advice for Savers:

- Look at your numbers. Separate out fact from fiction. How much do you have? How much does it take to run your house? How much is necessary to save? What are your long term goals?

- Set a “Spend Budget”. Seriously. If you’re a saver, push yourself to spend on nice things for you. Choose to spend money on fun things for you. Yes, you are worth it. No, the world isn’t going to end. Yes, there is more than enough money to go around. There is not a pot of money for the world and once that’s gone, it’s gone. It’s not like a pie that we all get a piece and if I get a bigger piece then you get a smaller piece. Money is like the oxygen in the room. You don’t need to take big gasps of air to save it for later this afternoon. When we are together, if I take a deep breath that doesn’t mean there’s less for you. You get to use what you need now as there will always be enough for you.

- Keep a diary of all your purchases and spending and look at it every week. Notice how you are able to earn money and how spending doesn’t lead to disaster or lack. Choose a money mindset mantra and post it on your mirror so you see it every day.

3. The Avoider:

Avoiders avoid looking at their accounts, talking about their finances, and making financial decisions. They can be either savers or spenders. Their avoidance creates stress and friction in their lives.

As with all of these money personalities, the beliefs and thoughts we have about money are deep routed in our past and how we were raised. Money avoiders often have past experiences (their own or some they’ve witnessed, eg their parents) where money was a source of disagreement, and tension.

Money avoiders tend to think of money and discussions about money with negativity, friction, and trouble. It is no wonder they approach money discussions or decisions with fear and anxiety.

Common Behaviors of Avoiders:

-You get uncomfortable talking or thinking about money.

-You let your bills stack up because you feel a sense of dread thinking of opening them up.

-You tend to hide purchases from your partner.

-Avoiders avoid making financial goals or plans.

-Avoiders often put someone else in charge of their money (a spouse or a parent).

Advice for Avoiders

- Start looking. Avoiders spend a lot of time in negative feeling states with all the thinking about avoiding and putting off looking at their bills and accounts. And so….choose to stop avoiding and look. Seriously, it’s that simple. Simple yet not easy. Yes, I know you’re telling yourself it’s hard. Yet, by avoiding money, you’re actually doing it harder. Avoiding looking at your accounts leads to unnecessary stress. You are adding a layer of drama into your life that is not needed. Your brain power is needed elsewhere. Please. Time and time again my clients resist looking at the accounts and yet, when they finally do, they feel relief. Every single time. The pain you’re bringing into your life through avoiding is unnecessary. Even if you have debt. Not knowing is always worse than knowing.

- Start Small with Daily Action: One tool that works really well for me and my clients is using an app called MINT. I use and clients have enjoyed is the app: MINT. It’s a free app that keeps all of your financial info in one place: credit cards, bank accounts, even mortgage or rental payments. It’s an easy way to begin moving out of the avoidance pattern. Your first step towards healing could be to insert your account information into the account without even looking at the numbers. Second step is to set a daily alarm for you to look at the numbers every day. I do this. One click, look, and then go about your day. Boom – your healing begins.

4. The Money Monk:

Money monks tend to think thoughts of money as being bad or dirty. They feel negatively towards money and wealthy people. They often think of money as a force unto itself, as if it is bad and, if they had it, they would do bad things. They think of it as having a power and that, if you have too much of it, it will corrupt you.

In general, money monks believe that “money is the root of all evil.” They tend to pass judgements on people with money and have trouble receiving money for their work in the world.

Very often, they have had past experiences when money was used to manipulate them or their family. Or they remember a family member doing work to earn money in a way that conflicted with their values. In general, they have a negative, dark view of money, almost as if money is alive and an external force they can’t control.

Common Behaviors of Money Monks:

-You resist asking for a raise or charging a fair market value for your work.

-You tend to dismiss the value of money and say things like: “I don’t need money” or “people who have a lot of money are greedy”.

-You don’t think it’s okay to have more than you “need” and so will often buy the cheap brand or go without.

-You give away your work (and sometimes even your things) for free.

-Money monks don’t trust money. They think it has the power to corrupt or change them or their relationships. They hold a deep fear of money that leads them to feel out of control.

Advice for Money Monks:

- Do some journaling or coaching work on how you view yourself and your worth. Remind yourself that you are here on earth for a purpose and that purpose provides a value to others. Money is a value and receiving it in exchange for your services is okay.

- Brainstorm a list of all the rich and generous people who are in this world: Oprah, The Gates, etc… Often this money personality had past experiences where money was used in a negative way. It’s helpful to start to reprogram how you view money and to look for all the great things money does for you and for others. “The more money I have, the more I can help” is a mantra I like repeating.

- Keep brainstorming and answer this question: “If I had more money, I would….:” and direct your mind to think of all the good things you can do with money. Money doesn’t make you something you’re not (so if you’re not greedy, more money won’t make you more greedy). Money makes you more of what you already are. It’s like putting a magnifying glass on your personality. If you’re a generous, caring individual, money will allow you to be more generous and caring.

Which Personality Are You?

All right warriors, there they are: 4 types of money personalities. Which do you identify with the most? Over my life, I have had pieces of most of these personalities show up. Life is a journey of learning about ourselves. The more open, curious and kind we can be as we observe our behaviors and tendencies, the more we live a life we genuinely love.

How you think about money says a lot about how you think about yourself. #moneymindset Share on XIt has been so important for me over my life to learn more about my thoughts on money, where they came from, and what I want them to be.

How Do You Want To Feel When You Think About Money?

Here’s the beautiful thing, you’re in charge.

It’s a thing. It doesn’t have power until you give it power.

It’s just numbers and we get to choose what we think about it.

The thoughts we choose create how we feel, drive the actions we take and create the results we see in our life.I choose to think of money as magical.

I choose to love money.

That used to be hard for me to say as money was used as a weapon in my past.

My thoughts and beliefs on money were most definitely holding me back. As are all unexamined thoughts and areas of our brain and unconsciousness. If you haven’t worked with a coach on your money mindset, I encourage you to reach out now.

How we think about money influences how we think about ourselves. It influences our children and the others around us. Coaches help you dig into your beliefs with kindness and direct you in a healthier way. You can not erase years of programming by yourself. Get started with the above tools and then please please please get a coach. I had such deep beliefs about money that were holding me back and now feel free and LOVE money!

I am grateful to it, feel free with it, and can’t wait to have more of it so that I can help even more awesome warriors! Let’s go!

Make sure you’re signed up to get my weekly Warrior Wellness email. It’s where you hear of all the great deals and behind the scenes of SMB and where I announce any contests, specials, or hand out freebies. I’d love to have you in our group!

Trackbacks/Pingbacks